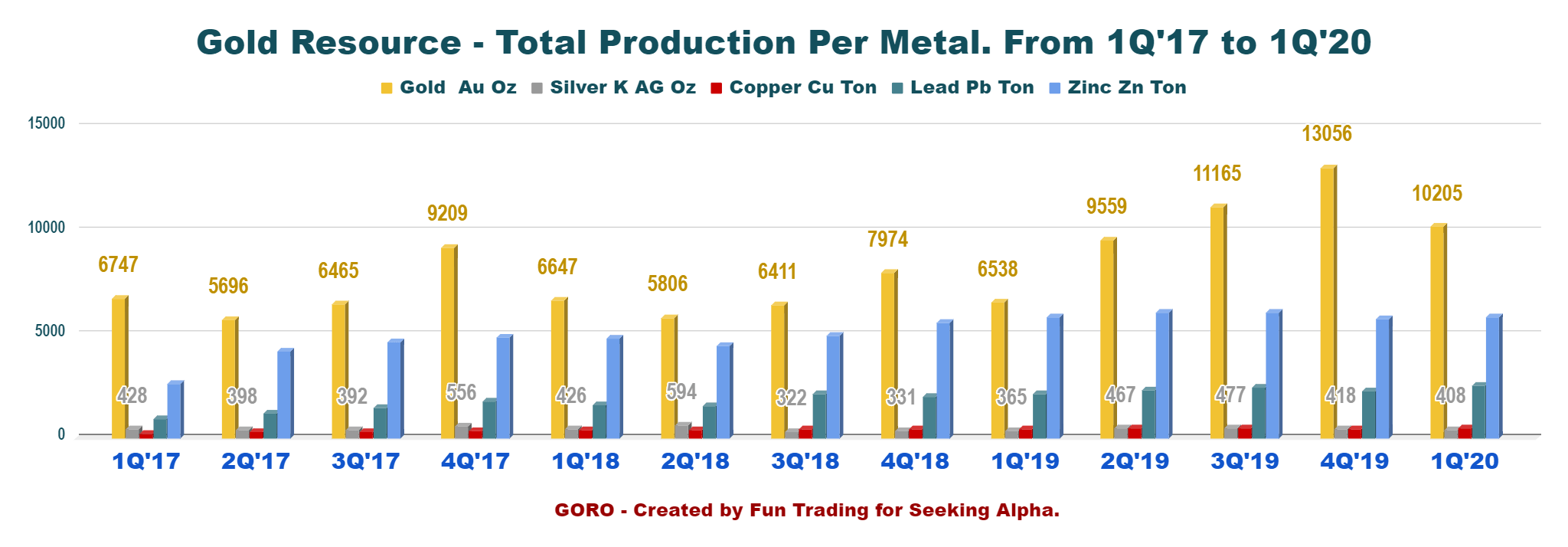

The company said it continues to target increased production levels in anticipation of increased milling capacity later this year, expecting a decrease in production costs with higher mill throughput.

The gold miner, with cash and equivalents of $30.4 million at quarter end, realized $12.5 million in cash flow from mine site operations and distributed dividends of $6.4 million or 12 cents per share for the three month period. Total cash costs were higher, at $645 per ounce of gold equivalent, including a five per cent royalty, compared to $509 per ounce in the same period last year. Precious metals prices dropped dramatically in the second quarter, with the price of gold tanking 23% during the period, hurting miners everywhere. The company sold 19,992 ounces of precious metal during the quarter, at realized average prices of $1,386 per ounce of gold and $23 per ounce of silver.

#Nysemkt goro full#

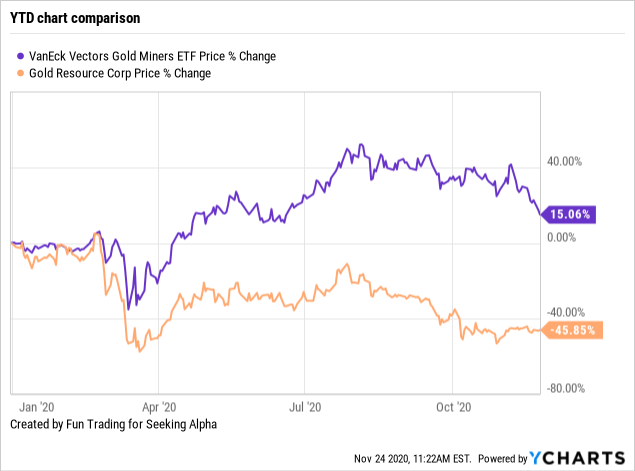

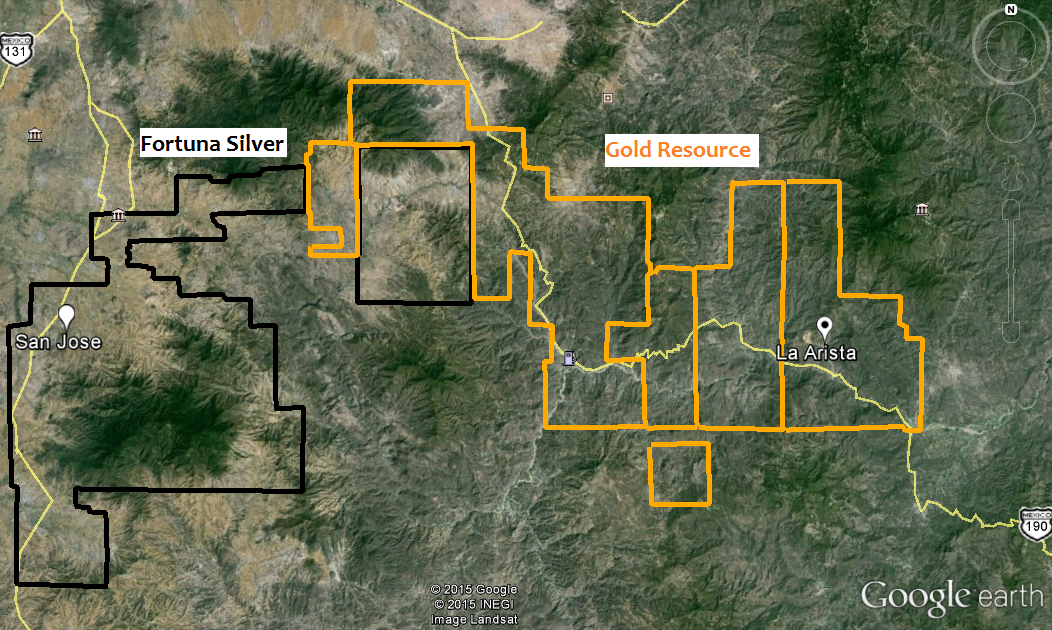

The miner said mill expansion was the main reason for the loss and expects costs to drop once the mill runs at full capacity. GORO stock analysis and financial data, including key statistics and ratios, valuations, historical price and financial performance of Gold Resource. It recorded a net loss of $1.37 million, or three cents per share, compared to a net profit of $4.13 million, or seven cents per share a year ago. The stock, which has exploded eight-fold since it began trading publically in 2006, has a yield of about 4%.Įarlier this month, Gold Resource reported a 42% rise in production in the second quarter. The ex-date for the payout is August 8, while the date of record is August 12. As of the end of July, Gold Resource had returned $86 million to shareholders. The Colorado Springs, Colorado-based company, which has a 100% interest in six properties in the Mexican state Oaxaca, paid its first dividend three years ago. (NYSEMKT:GORO) is surging 5.4% on Friday morning after declaring a monthly three cent dividend. In March, Gold Resource Corp also announced that it had begun the transition from processing lower grade, open pit ore, to processing underground ore from the high grade Arista deposit at El Aguila - well ahead of the original mid-year target.Gold Resource Corp. Gold Resource (NYSEMKT:GORO) declares 0.0017/share monthly dividend, in line with previous.Forward yield of 0.39Payable May 23 for shareholders of record. This marked a significant improvement from the first six months of production, when the company generated 10,493 ounces of gold at a cash cost of $217 per ounce. Indeed, in early May, the company posted its first ever profit and record revenue, as it continues to ramp up operations at its El Aguila project in Oaxaca, Mexico.ĭuring the first three months of the year, the property produced 7,479 ounces of gold equivalent at a cash cost of just $87 per ounce. Cash from operating activities at our Don David Gold Mine were 6.8 million and working capital was nearly 32.5 million at March 31, 2021, an increase of 5 from year end. "We believe this inclusion may increase Gold Resource Corporation’s visibility and recognition with the institutional investment community."

"Having successfully positioned the company among the elite class of low cost gold producers with an aggressive growth curve and a history of 12 consecutive monthly dividends, we are proud to be included in such a well-known and recognized index.

"Gold Resource Corporation’s inclusion on the Russell 3000 and Global indexes this year marks another milestone in the Company’s evolution," said president Jason Reid. The company will hold its membership in the Russell indexes until the firm announces a new set in June of next year. The relatively new gold producer has returned more than $20 million to shareholders in special dividends, since declaring commercial production at its El Aguila project in July of 2010. Russell reconstituted its set of US and global equity indexes on June 24, adding Gold Resource Corp, a low-cost gold producer with operations in southern Mexico. Russell Investments' indexes are used by investment managers and institutional investors for investment strategies. Gold Resource Corp ( AMEX:GORO) said Monday that it was added to the Russell 3000 and Russell Global indexes at the end of June.

0 kommentar(er)

0 kommentar(er)